During the Coronavirus (COVID-19) pandemic and economic recession in 2020, the share of U.S....

How Long Will High Interest Rates Last?

Mortgage interest rates just hit a twenty-year high, topping 7%. This is faintly amusing to some of us as our first home had a 7% interest rate thanks to the VA, and we celebrated what a bargain it was.

Coupled with the rising cost of housing, it has placed homeownership out of reach for many Americans. It also has another effect: mortgage bonding. During the still unbelievable run this century of interest rates as low as two-something, those long-term mortgages are a powerful inducement to not move.

For farmers, many of whom are looking at sub-4% long-term land financing, the real interest rate when inflation is added in is zero or even negative.

High borrowing costs will slowly dampen farmer demand for acres as record land prices mean all but a few will have to borrow some to buy. Buying out siblings in an estate settlement has become much more challenging. Similarly, speeding up the payoff of a mortgage to get out of debt makes less sense if that extra cash could be safely invested at more than your old mortgage rate.

Interest rates will slow the turnover rate for real estate, but eventually some of us will have to bite the mortgage bullet. The question becomes, “How long can high rates last?”

Maybe history can help.

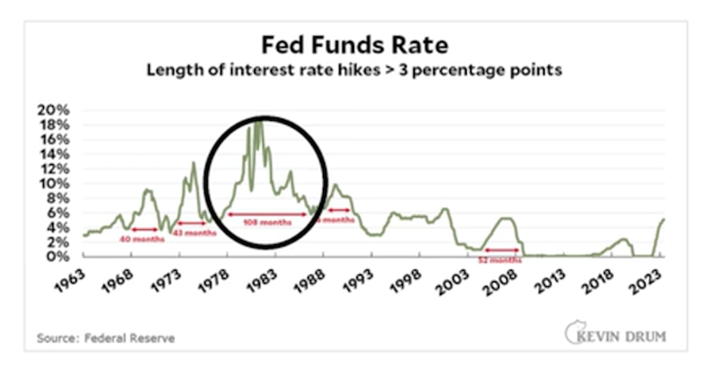

This graph from Kevin Drum shows the duration of rate increases of more than 3 points. The nine years of the eighties is grim but the oil price spike was probably unique. The other rate increases seem to suggest about 3 to 4 years. Since rates began going up March 2022, a reasonable guess would be late 2025 at the earliest to return to previous rates.

The problem with this historical approach is rate increases were previously forced back down by a faltering economy, which is not the case today. GDP growth, unemployment, and consumer spending are not shouting recession – just the opposite. Our economy is doing well comparatively. My guess is to watch the housing market, because it may be the most sensitive sector, and buyers can only stall so long.

Another indicator will be employee quits as workers are essentially frozen into that earlier 4% mortgage, and it would take a whopping raise or much lower interest rates to get them to move.

Above all, we should look at this graph and marvel at an unprecedented era of cheap borrowing.

EDITOR’S TAKE:

After a decade and a half of near zero interest rates, any increase is bound to feel uncomfortable. The challenge today is not simply rising interest rates, but the double whammy of record inflation and interest rates. According to most economic data, the average consumer is spending nearly $1,000 per month more to purchase the same bundle of goods compared to January 2020. It is no wonder that consumers are feeling the pinch and holding off on some major purchases and even some necessities for many families. So far, agriculture is blessed with record or near record net farm income the past several years. In addition, the value of their land continues to escalate at a very rapid pace, thus, making their balance sheets look very attractive! Make sure you put some effort into marketing to farmers/ranchers in your area. Use your local radio, TV or print channels, but don’t forget to use AgTruckTrader.com. AgTT specifically targets farmers and ranchers and is an excellent tool to help you engage with them. After all, they have money and they purchase or lease a lot of trucks every single year. Don’t miss out on this prime opportunity!