Delivering a load of fresh fruits or vegetables on time and in good condition is no easy task. “You...

All Market Eyes on South American Soybean Production

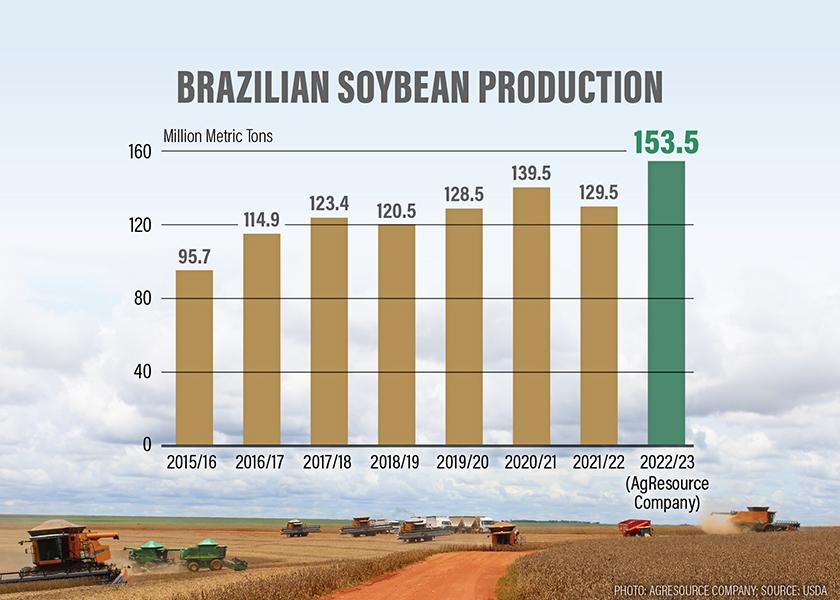

Farmers from across North America at Top Producer Summit in Nashville, Tennessee, made it clear there is one issue top of mind: South American soybean production.

“When we were on the ground in January, our pod counts were record large,” says Dan Basse, President of AgResource Company. Just as harvest began ramping up, his company completed a crop tour of Brazil’s largest production area, Mato Grosso. He says everyone is going to have to raise their estimates for soybean production in 2023.

“When we look at the total Brazilian soybean crop, it’s 154 million metric tons as of today and last year was around 129,” Basse says. “So, this is significantly larger.”

Maybe even more impressive are the yield average estimates from Mato Grosso. AgResource is forecasting the country’s largest producing state will see 60.3 bu. per acre. In 2022, Iowa averaged 58.5 bu. per acre, and Mato Grosso is larger than the three “I” states (Illinois/Iowa/Indiana) combined.

While La Niña-driven dryness hurt crops in southern Brazil and Argentina, the large production area in Mato Grosso will help make up the shortfall. In late January, the Buenos Aires Grain Exchange rated Argentina soybeans at just 7% good-to-excellent.

“Right now, we’re on a trend of lower U.S. grain exports because of a record crop in Brazil and its big export potential,” says Steve Freed, Vice President of Grain Research for ADM Investor Services.

Basse agrees: “Brazil will be an exporter of size and substance all the way through next October.”

So, what does all this mean for U.S. producers who are preparing to plant a crop this spring?

“The 2022 rally was all about lower supplies,” Freed says. “2023 is going to be about lower demand as prices try to compete with the fact that all these other origins are now cheaper than us.”

EDITOR’S TAKE:

Soybean producers are not strangers to competition from Brazil and Argentina. A great deal of our competitive advantage comes from the relative strength or weakness of the U.S. dollar in relation to importing countries. Another key is the superior quality of U.S. soybeans. In addition, with shipping rates on the decline for U.S. products, that will help lower our basis at U.S. ports.

It is not panic time by any stretch. Soybean production in the U.S. can and will compete with other countries all day long. Our soybean producers will have plenty of money this fall to purchase one or two or more of your trucks that are once again building up on your lot. In fact, there is still time to invite them to your dealership for a pre-planting service special. Be sure to make them aware that you are a CAD member who offers AgPack®! You have a lot of partners just waiting to help you achieve more success!